ComplianceinChina.com

conducted surveys on Chinese corporate compliance management for three

consecutive years. Under the auspices of ComplianceinChina.com, one of the

largest and earliest compliance platforms in China, The Compliance Reviews

(www.compliance.reviews or www.compliancereviews.cn) is an English electronic

journal aiming to enhance compliance and risk management in Asia and beyond.

In the year 2016,

ComplianceinChina.com conducted a Chinese survey through its WeChat account 合规 (literal translation as compliance).

The survey began on August 28, 2016, and continued through January 25,

2017, with 425 participants.

According to survey

data, 83% of the participants of this survey were compliance officers or functionaries,

with 119 senior compliance officers (i.e., country or regional directors) and

233 junior or middle-levelled compliance officers. The remaining 17% presumptively included

business managers or other functionaries. That being said, with a 83% of participants

directly involved in corporate compliance management, the survey reflects

China’s modern landscape of compliance management.

As according to our

custom, we are issuing our survey results before the Chinese New Year, which

falls on January 28th this year.

If you have any questions

about this survey, please do not hesitate to contact

henry@compliancereviews.cn.

Hereinafter are the

survey results:

1.

Foreign-invested enterprises have placed greater emphasis on compliance.

A foreign-invested

enterprise is an enterprise that has at least one shareholder from a

non-Chinese country.

Out of 425 participants,

201 participants (47%) revealed that the companies they are affiliated with are

foreign-invested enterprises with a compliance function. Only 13 participants (3%) selected that their

respective company are foreign-invested enterprise without a

compliance function.

In comparison with

foreign-invested enterprises, state-owned enterprises and private businesses

care less for compliance management.

There are 88 participants from state-owned enterprises (21%), and 68

from private businesses (16%) claiming that they have compliance functions, far

less than the 47% of foreign-invested enterprises with compliance functions.

Compared with 3% of

foreign-invested enterprises without compliance functions, 4% of state-owned

enterprises and 7% of private businesses do not have compliance functions.

2.

Fear of different punishments is the main motive behind compliance functions

Compliance is defined

as the observance of law or corporate code.

For the multiple-choice question “What is the driving force behind

compliance policies in your company?”,

--214 (28%) selected

“if my company is punished, I am doomed” (25% in 2015)

--178 (23%) selected

“high-levelled executives will be subject to personal liabilities including

criminal liabilities” (29% and ranked No. 1 in the year of 2015).

--137 (18%) selected

“My company will punish me” (22% in last year).

--222 (29% and ranked

No. 1) selected “Compliance is the biggest wisdom of a long-lasting company”

(22% in last year.)

According to the survey

results, 69% percent of participants comply with law or corporate code out of

fear for something; 29% believe that compliance is wisdom to ensure the

longevity of a long-lasting company.

If you wish to learn

more about the driving force behind compliance, below are some helpful

articles.

Can we swim out of that water of sorrow? (in

Chinese language)

Why shall we

“compliance”? (in Chinese language)

Integrity and

compliance shall be the corner stone of corporate culture (in Chinese language)

3.

Lack of cooperation from the colleagues of business departments and inadequate

support from higher-ranking officials are two large obstacles facing Chinese

compliance.

For the multi-choice

question, what are the difficulties for corporate compliance? The difficulty No. 1 is that business

departments do not buy it (247 selections taking 20%), which was ranked No. 1

as well in 2015 amounting to 21%. About

this article, you may read the article of Tone from

the Middle Cannot be Ignored (in English language).

The difficulty No. 2 is

that the top does not support (167 selections taking 14%).

Difficulty No. 3 is

that birds of compliance eat nothing (156 selections taking 13%), which was

ranked No. 2 in 2015 taking 16%. About

this topic, please read the article of the Impact of Dodd-Frank on U.S.

Companies Doing Business in China (in English language with Chinese

introduction).

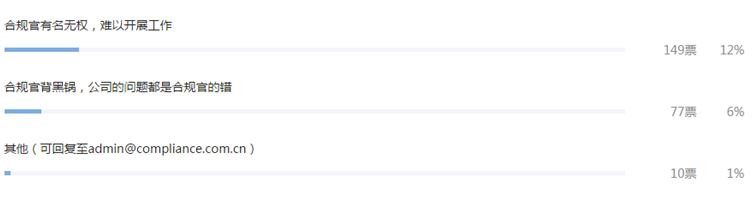

Difficulty No. 4 is

that compliance officers do not have power and cannot carry out their work (149

selections taking 12%).

Difficulty No. 5 and

No. 6 are about law-making and law-enforcement.

There were 125 selections of “the enforcement of law is arbitrary” (10%)

and 124 selections of “law is not clear” (10% as well).

Difficulty No. 7 is

about compliance officers themselves – 110 selected that that my capacity is

disproportionate to my desire of doing compliance well (9%), which was 15% in

the year of 2015.

Difficulty No. 8 is

that compliance officer is the scape-goat taking blames for any wrong doing (77

selections taking 6%).

Difficulty No. 9 is

that compliance is window dressing which is not much useful (with 67 selections

taking 5%).

There are 16 selecting

others amounting to 1%.

4.

Even though anti-bribery remains a large part of compliance in China, compliance

has begun to branch out into other areas.

Anti-bribery is ranked

as compliance duty No. 1 with 392 selections (18%), a two point decrease from

the 20% result in the 2015 survey.

Compliance with internal

codes of corporate and anti-money laundering are ranked respectively No. 2 (with

353 selections) and No.3 (with 347 selections).

Each of them amounts to 16%.

Anti-monopoly has 304

selections ranked No. 4 (14%), which was 16% in the year of 2015.

There were 294 people

selecting the protection of personal information as compliance duty, which is

ranked No. 5 taking 13%, which was 16% in the year of 2015. With the same 13%, 290 people selected other

laws.

No. 7 is about the duty

of protecting environmental, which amounts to 9%.

5.

About 1/10 companies never do compliance training; about half of the companies

do trainings just once or twice per year.

About half of the

participants selected the option “once or two trainings per year” (198

selections, 47%).

About a quarter does

compliance training more than 5 times per year (102 selections, 24%), and 17% of

the participants do training 3 or 4 times per year.

11% of participants

selected “No Training".

6.

On anti-bribery, Chinese law is the most important among other compliance

duties.

When asked “what are

your compliance duties on anti-bribery”, 394 selected Chinese anti-bribery law

amounting to 48%, a 11% increase from the 37% from the 2015 survey.

In terms of the FCPA,

there were 216 selections amounting to 26%; in terms of the UK Bribery Act, 139

people made selections amounting to 17%.

Despite the dwarfed rankings, we believe the FCPA is still the most influential

law for those on whom the FCPA is applicable, so is UK Bribery Act. It is worth

mentioning that 72 people selected other laws, which could include Sapin II –

the “FCPA” of French version. About this

topic, please read the article of France Has its Own FCPA with More Severe Punishment (in Chinese language). Please refer to the article Why Is Chinese Anti-Bribery Law a Very Important Compliance Obligation?

7.

Half of companies believe that compliance in 2016 was harder than before.

About 216 participants

believed that the compliance job in 2016 is harder than before (taking 51%);

130 selected no change. However, 71

believed that it was easier, amounting to 17%.

8.

Compliance awareness and performances were dramatically enhanced in 2016.

About 271 people

selected that “the compliance awareness and performance are enhanced”,

amounting to 64%.

Despite 22 people

selecting “weaker” (only amounting to 5%), there were 126 people selected “Same

as previous"(amounting to 30%).

9.

Some senior compliance officers were paid well; some were not.

This year, we surveyed

about how a senior compliance officer was paid (senior compliance officer

includes country or regional director); 113 participants fall within this

category.

Among the 113 senior

compliance officers, 8 selected that their pre-tax salary (including bonus) is

above RMB 3 million (about US$ 440,000 at the conversion rate of 6.8) amounting

to 7%.

There were 9 people

selecting between RMB 2-3 million (about US$ 294,000 to US$ 440,000 at the

conversion rate of 6.8) , which amounts to 8% among total 113 participants.

There were 35 senior

compliance officers selecting between RMB 1 - 2 million (about US$147,000 to

US$ 294,000 at the conversion rate of 6.8); 61 senior compliance officers

selecting below RMB 1 million.

10.

Some junior or middle-levelled compliance officers are paid very well, but most

are paid below US$ 74K annually.

There were 239 junior

or middle-levelled compliance officers are involved in the question on salary

of junior or middle-levelled compliance officers.

Five of 239 (2%) said

that their pre-tax salary (including bonus) was more than RMB 2 million (about

US$ 294,000 at the conversion rate of 6.8); 7 (3%) selected the category

between RMB 1 - 2 million (about US$147,000 to US$ 294,000 at the conversion

rate of 6.8).

There were 58 (24%) who

selected the category between RMB 500,000 to 1 million (about US$ 74,000 to US$

147,000 at the conversion rate of 6.8), and there were 169 selecting below RMB

500,000, which amounts to 71%.

If you have any questions

about this report, please do not hesitate to contact

henry.chen@dentons.cn.

*The author Henry Chen, a Senior Partner of Dentons Shanghai Office, is licensed to practice law in China and the New York State of the U.S. Before joining Dentons, Henry worked in Ford as its AP Compliance Director. Henry Chen is a representative of China Delegation to negotiate over ISO19600 Compliance Management System - Guidelines, and the Vice Director of the Working Committee on China national standard Compliance Management System. Henry Chen is the author of the book Commercial Bribery Risk Management in China. You may also visit Henry's column "Competition & Monopoly" maintained with Caixin Media. Henry is available at henry.chen@dentons.cn