China recently indicated that it will reform the current registered capital requirements for companies in China. The changes, once made, will significantly simplify foreign investment in China.

The reform plans were announced by Chinese Premier Li Keqiang at an executive meeting of the State Council on 25 October 2013. The goal of the reform is to support a faster pace of economic reform and to encourage investment in China. Highlights of the reform include changing the current paid-up capital regime to a subscribed capital regime, lifting minimum registered capital requirements and relaxing timing requirements for capital contribution. With these changes, China plans to align its company registration system with international practice.

The State Administration for Industry and Commerce (SAIC) is currently coordinating with various governmental bodies to amend the Chinese Company Law and to promulgate new regulations in order to implement the reform. SAIC officials have stated that, based on the principle of national treatment, all foreign-invested enterprises (FIEs) will benefit from the new rules.

Following a brief explanation of “total investment” and “registered capital” under the current foreign investment regime, we outline below the current rules and indicate how they can be expected to change:

Total investment and registered capital

An FIE must have a registered capital and a total investment.

Registered capital is the total amount of equity made by the investors to the FIE, which must be paid in accordance with time schedules prescribed by law.

Total investment is the projected amount of capital necessary for the FIE to be established and become operational. An FIE may borrow foreign exchange loans up to the difference between its registered capital and total investment.

An FIE’s registered capital is subject to a fixed proportion of its total investment. For instance, an FIE with a total investment of up to US$3 million must be funded by at least 70% registered capital. This limits the amount of foreign debt that an FIE can incur.

Under the proposed reform, investors of an FIE may contractually agree on the capital to be subscribed. They may also agree on the form and timing of contributions. However, other than the matters set out below, it is unclear whether or how the proposed reform will impact China’s overall foreign investment regime.

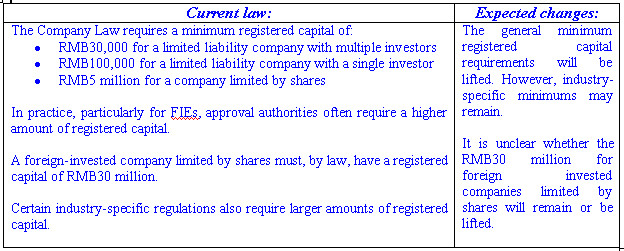

Minimum amounts of registered capital

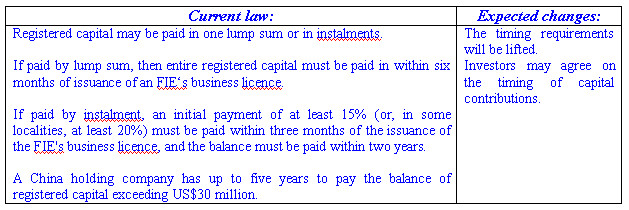

Timing of capital contributions

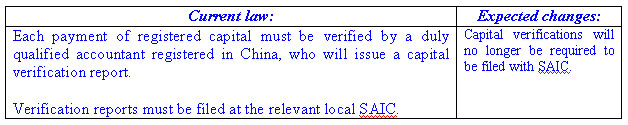

Capital verification

Our observations

While the direction of reform is good news for foreign investors, the actual benefits derived will depend very much on the implementing details. For instance, we do not yet know whether the concept of total investment will still be applicable. As the difference between total investment and registered capital limits an FIE’s foreign exchange borrowing capacity, it is unclear whether the reform will impact foreign exchange financing of FIEs.

Another area of uncertainty, at this stage, relates to the FIE approval regime. Under the current FIE approval regime, the total investment is one of the factors to determine whether an FIE is subject to approval at the municipal, provincial or central level. If the concept of total investment is abolished along with the concept of registered capital, then the FIE approval system will also need to be revised. It may be that China is contemplating a registration-only system for FIEs, similar to the one being rolled out in the Shanghai Free Trade Zone.

The relaxation of registered capital requirements confirms that the Chinese authorities are planning to transform the post-establishment supervision of companies in China. New policies in this respect were announced in the same State Council’s executive meeting. The announced policies include replacement of the current enterprise annual inspection system with a more transparent and unified annual reporting system whereby annual reports of enterprises will be made available to the public. In addition, it was announced that an enterprise credit system would be developed so that non-compliant companies can be “blacklisted” on a publicly available register.

Foreign investors and FIEs in China should keep a close eye out for the implementing laws and regulations. Subject to the announced details, implementation of the reform could well be some of the most significant foreign investment changes over the last decade.

* Karen Ip, a partner of Herbert Smith Freehills, is principally involved in private equity investment projects, merger and acquisition transactions and greenfield investments in the manufacturing, infrastructure and financial institution sectors. She also advises on regulatory issues in China.